NY CR-Q1 2014 free printable template

Show details

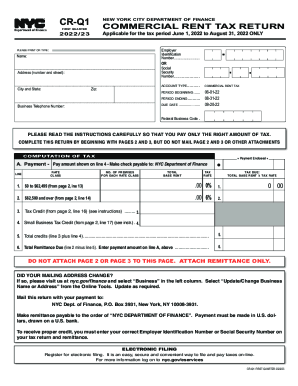

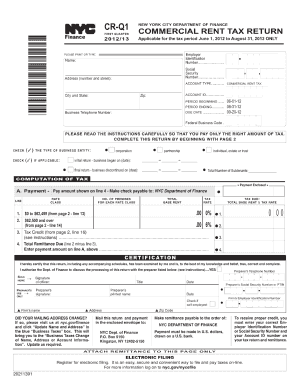

TM Finance CR-Q1 NEW YORK CITY DEPARTMENT OF FINANCE COMMERCIAL RENT TAX RETURN FIRST QUARTER Applicable for the tax period June 1, 2014, to August 31, 2014, ONLY 2014/15 Employer Identification Number

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your cr q1 form 2014 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cr q1 form 2014 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cr q1 form 2014 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cr q1 form 2014. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

NY CR-Q1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out cr q1 form 2014

How to fill out cr q1 form 2014?

01

Make sure you have all the necessary information and documents ready before starting to fill out the form.

02

Begin by entering your personal details such as your name, address, contact information, and social security number in the designated sections.

03

Next, provide information about your current employment status, including your employer's name, address, and contact information.

04

Ensure that you accurately report your income for the specified year. This may involve attaching additional documents such as W-2 forms or other income statements.

05

If applicable, indicate any deductions or credits that you are eligible for, such as childcare expenses or education credits. Provide supporting documentation as required.

06

Double-check all the details you have entered to ensure accuracy and completeness.

07

Sign and date the form before submitting it to the appropriate authority.

Who needs cr q1 form 2014?

01

Individuals who were required to file a federal income tax return for the specified year.

02

Individuals who had income from self-employment, partnerships, or S corporations.

03

Individuals who received income from sources other than wages, such as rental income, interest, dividends, etc.

04

Individuals who claimed itemized deductions or certain credits on their federal tax return.

05

Individuals who had adjustments to their income, such as education expenses or IRA contributions.

06

Generally, anyone who had taxable income and needed to report it to the IRS in compliance with federal tax laws.

07

It is important to consult with a tax professional or refer to the IRS guidelines to determine if you specifically need to fill out the cr q1 form 2014 based on your individual circumstances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cr q1 form 2014 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your cr q1 form 2014 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I edit cr q1 form 2014 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign cr q1 form 2014 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit cr q1 form 2014 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute cr q1 form 2014 from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your cr q1 form 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.